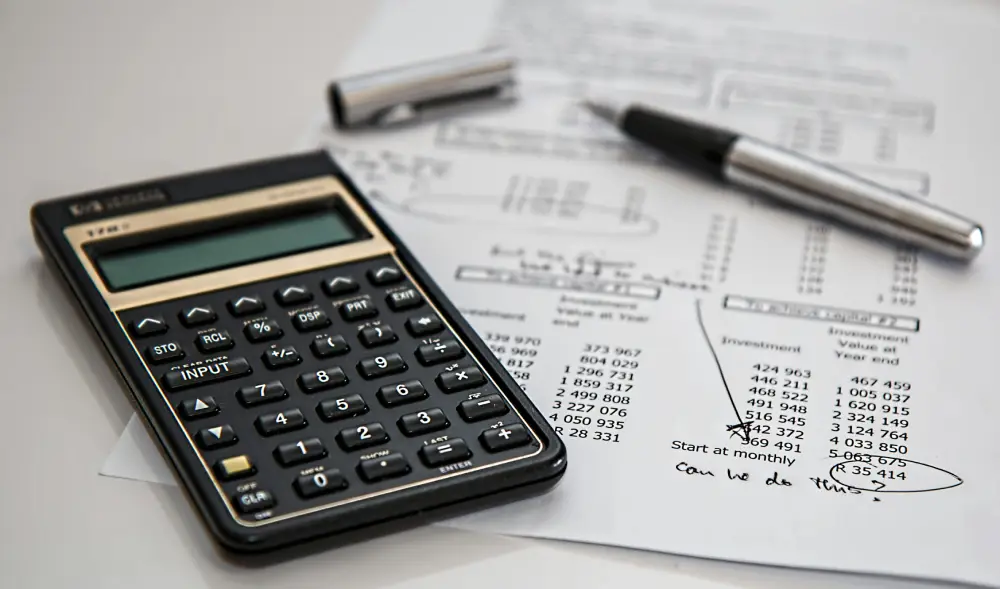

The anticipation surrounding Nirmala Sitharaman’s Budget 2024 has reached fever pitch. Set against a backdrop of economic recovery and growth, this budget is expected to address key fiscal challenges while driving the nation towards a more prosperous future. With diverse expectations from various sectors, let’s dive into what this budget entails and its potential impact on the Indian economy.

Key Highlights of Budget 2024

Nirmala Sitharaman’s Budget 2024 has been keenly awaited, with significant policy shifts anticipated across various domains.

- Increased Capital Expenditure: The capital expenditure outlay has been increased by 11.1%, amounting to ₹11,11,111 crores.

- Focus on Infrastructure: Substantial investments in rail, road, and urban infrastructure development.

- Tax Reforms: Expected changes in income tax slabs to benefit salaried individuals.

- Support for Small Businesses: Initiatives to bolster SMEs and startups.

For a more detailed look at the budget, you can refer to the India Budget site.

Tax Proposals and Reforms

A significant aspect of Budget 2024 is the reform in tax policies aimed at providing relief to the common man.

- Revised Income Tax Slabs: Adjustments in income tax slabs to increase the exemption limit, providing relief to salaried individuals. Find more details on the expected tax benefits here.

- Corporate Tax Adjustments: Proposals aimed at making India an attractive destination for businesses.

- GST Reforms: Simplification of the GST compliance process to ease the burden on smaller enterprises.

Also Read: Union Budget 2024-2025: Key Dates, Focus Areas, and What to Expect

Infrastructure Development

The budget places a strong emphasis on infrastructure, considering it the backbone of economic growth.

- Transportation: Massive investments in rail and road networks to improve connectivity. For insights, check out the Times of India’s coverage.

- Urban Development: Enhancement of city infrastructure to handle the growing urban population.

- Rural Connectivity: Improved road networks in rural areas to encourage balanced regional development.

Sector-Specific Impacts

Different sectors reacted uniquely to the budget, with both challenges and opportunities highlighted.

Aviation Sector

The aviation sector is poised for expansion under Budget 2024.

- Airport Development: Funding for airport expansions across key cities to handle increasing passenger traffic.

- New Air Routes: Introduction of new domestic and international routes to improve connectivity. You can learn more about the aviation-related announcements at the Budget Highlights.

Tourism Initiatives

To boost domestic tourism, several initiatives have been announced.

- Interest-Free Loans: States to receive interest-free loans to boost local tourism infrastructure.

- Development Programs: Launch of programs aimed at promoting cultural and heritage tourism.

Economic Growth and Employment

Stimulating economic growth and creating job opportunities are central to this budget.

Support for Small Businesses

Supporting small businesses is critical for economic resilience.

- SME Initiatives: Introduction of funds and tax rebates to support SMEs.

- Startup Support: Policies to encourage entrepreneurship and innovation in technology and other sectors.

Job Creation Strategies

Job creation is crucial given the current employment scenario.

- Skill Development Programs: Large-scale skill development initiatives to align workforce skills with industry needs.

- Public-Private Partnerships: Encouragement of partnerships to drive job growth in various sectors.

Also Read: 10 Essential Tips for Maintaining Your Motorcycle

Public and Expert Reactions

The initial reactions to the budget came from various stakeholders, each holding their unique perspectives.

Economic Analysts’ Views

Experts have voiced their opinions on the budget’s long-term impacts.

- Positive Outlook: Analysts highlight the potential for long-term growth due to increased infrastructure spending and tax reforms. Details can be accessed in the Economic Times’ expert coverage.

- Cautionary Notes: Concerns over fiscal deficit and implementation challenges are also noted.

Public Opinion

The general public has shared mixed reactions to the budget.

- Positive Response: Many welcome the tax reliefs and focus on infrastructure.

- Criticisms: Some express concerns over the effective implementation of policies and their immediate impact on daily life.

Conclusion

Nirmala Sitharaman’s Budget 2024 is a mix of ambitious reforms and pragmatic measures aimed at driving India towards sustained growth. While it promises significant relief and development, the real test will be in its implementation and the tangible outcomes it delivers over the year.

For a comprehensive overview of all key announcements, refer to the official India Budget page. This budget, much like cutting through the knots of a complex tapestry, seeks to unravel pathways to prosperity and equitable growth for all.